First for a definition : the term inflation means the growth of the money supply. Yes, I'm well aware there's a small majority of hacks pompously calling themselves "economists" who have accepted hook line and sinker the redefinition socialists pushed. I'm also aware the reason they pushed it was to suit their purposes of lying to people so as to make stealing from them easier. Nevertheless, the original definition is an increase in the amount of money in circulation and that's what we're talking about here, not the Keynesian bureaucratic bull.

The Adamantine Limit

Bitcoin is designed for stable, predictable and verifiable money supply growth. The supply of coins is incremented approximately every 10 minutes and the supply is set to a hard limit : there never will be more than 2`099`999`997`690`000 satoshis(i) ever in existence (20`999`999.97690000 BTC). Here's a side note to ponder : it's estimated there are something to the tune of 46 million millionaires globally if we're measuring in dollars federal reserve notes. That is, there will never be enough Bitcoin to go around for all paper(ii) fiat millionaires to have 0.5 BTC.

The Coin Distribution Competition

Bitcoin comes into existence as a reward to a competition(iii) of solving a contrived mathematical puzzle called Hashcash Proof of Work. What is this hashing business you ask ? A hash(iv) function takes an unbounded input and produces a fixed size output. The output is a random, uniform distribution that is not known in advance. The only way to find a desired output if you don't have the inputs is to guess and check many times, which in Bitcoin is called mining. Guessing and checking is not free, it requires computers and electricity to power and cool them. The point of this constraint is to force miners to have skin in the game and align their incentives to act honestly because they have to spend resources to win the new money and change the history of the system, aka blockchain.

Hash functions are an example of a mathematical trapdoor function. They're called trapdoors because it's easy to go one way, but hard to go the other way, i.e. it's easy to fall into a trapdoor, but once you're down there, your chances of getting out are slim.(v) For hash functions, if you have the input, it's cheap to compute the output ; though if you start with an output and want to find its input, you're screwed if the hash function is any good. So, it might take a miner a long time and many resources to find a solution, but once he finds it, it's cheap for his Peers to check his work.(vi) A general problem in cryptography is there are no known hash functions which are mathematically proven to be secure. There are two classes of hash functions : a) those that people thought at one time to be strong, but later were shown to be wrong, e.g. md5, and b) those which people haven't yet figured out how to break. It doesn't mean someone will in fact break Bitcoin's hash functions, but we can't rule out such a Black Swan.(vii)

Bitcoin uses Secure Hash Algorithm 256 (SHA256) for coin generation. The 256 indicates a 256 bit output. 2256 is approximately 1077. To give this number some context, the earth is estimated to weigh 5.98 x 1027 grams. That is, if each gram of the earth were cut out and all lined up in a row, that would only form one side of a cube that holds all the possible outputs for SHA256. Far out man.

How about some examples to show you what I mean with this business.

| Input | Output |

|---|---|

| THIS IS SHA256 | 98b040a3cbb5ae36060729a2b0d57b3c81ae9a1649d4da9b9b554c5478dcf5c2 |

| this is sha256 | 2f4c6b79b3d0fd07fc30c9dd7aeea0f2b2483801e344eb4253eebb63a2cdc192 |

| The Merchant of Venice(viii) | 48c6489962c0555352ed5d5eafa7962ceea8dbaa9926530fc0fe98d28bc17e92 |

With the first and second items, you see that while the strings are the same apart from capitalization of the former, the outputs are drastically different. Comparing the third item, the input length is substantially bigger, but the output length is the same 256 bits as the first two. The takeaway is that even slight changes in the input produce substantial changes in the output and variable length inputs produce fixed length outputs.

So how is this hashing tool implemented to produce stable, predictable inflation ? You'll find it's an ingeniously elegant device if you're patient enough with yourself to understand it. You see, the challenge the Bitcoin protocol presents to miners who are after the new money issuance is to find a SHA256 output with a given number of leading zeros. As competition rises and recedes, the difficulty of the challenge is adjusted by changing the number of leading zeros required to win the reward. Have a look at some examples over time :

| Block | Block Hash |

|---|---|

| Genesis | 000000000019d6689c085ae165831e934ff763ae46a2a6c172b3f1b60a8ce26f |

| 1`337(ix) | 000000008bf44a528a09d203203a6a97c165cf53a92ecc27aed0b49b86a19564 |

| 13`337 | 00000000aeeba6715e296db9b97f0692b58ac77c40199cdb5e4a1116d2059646 |

| 133`337 | 0000000000000608f2af09913562351552e14d10f9250579cc0d89248402be45 |

| 210`000 | 000000000000048b95347e83192f69cf0366076336c639f9b7228e9ba171342e |

| 420`000 | 000000000000000002cce816c0ab2c5c269cb081896b7dcb34b8422d6b74ffa1 |

| 630`000 | 000000000000000000024bead8df69990852c202db0e0097c1a12ea637d7e96d |

| 721`915 | 0000000000000000000057c27247655366e08e17b0beb52f9b9245df422083cd |

| 780`707 | 0000000000000000000412921015c683dc5480076a2d91e60a4513bd9fe7a55e |

As we can see, the Genesis Block, where Satoshi famously inscribed, "The Times 03/Jan/2009 Chancellor on brink of second bailout for banks" (x), was found at a higher difficulty than blocks 1`337 and 13`337, but by block 133`337 the difficulty was orders of magnitude higher as the competition heated up.

Maintaining the Inflation Target with Difficulty Adjustments

The inflation target is to have a new block, and thus new Bitcoin, discovered approximately every 10 minutes. Every two weeks, the system automatically checks if it's behind or ahead of schedule. If it's ahead of schedule, it increases the difficulty, if it's behind schedule, it decreases the difficulty. "Oh, a big chuck of the network went offline because XYZ catastrophe. Well, I guess we'll have a waiting a bit longer than normal for transactions clear while the difficulty adjusts and people come back online, but at least we'll survive."

A Supply Curve of Positive Exponential Decay

Bitcoin's supply curve function has positive exponential decay because it decreases as it approaches the asymptote of ~21 M.(xi) Every 210`000 blocks, the block reward decreases 50%. It started at 50 BTC per block and it came to pass that the first halving took place on November 28th, 2012 when a n00b named laughingbear.worker1 solo-mined block 210`000, tru story. From then until July 9th, 2016 the reward was 25 BTC per block at which point it halved to 12.5 BTC per block until May 11th, 2020 when it became 6.25 BTC.

That's right, Bitcoin was the only major currency in the world to restrict money supply growth during the peak of the panicdemic when all the other central bankers bezzlers were jamming CRTL-p on their Windows(xii) laughingstock of an operating system to add zeros to the left side of the decimal point of their friends' accounts. Socialists sez, "Hey look, less than 0.1% of people are getting sick, but we've injected a plethora(xiii) of panic into the other lobe of the stuple so it looks like a good time to take the money supply exponential, yet again". Bitcoin capitalists reply, "Mno, fuck that noise, we're staying on schedule, prices will adjust to the 'crisis', that's what they're for, anyways". So I ask you, esteemed readership, is there a surer bet in the monetary policy space that Bitcoin will halve yet again in 2024(xiv) ? What happens first though, central bezzler's cutting "rates" or the fourth Bitcoin block reward halving ? Clocks are ticking, miners are hashing, what're you doing ?

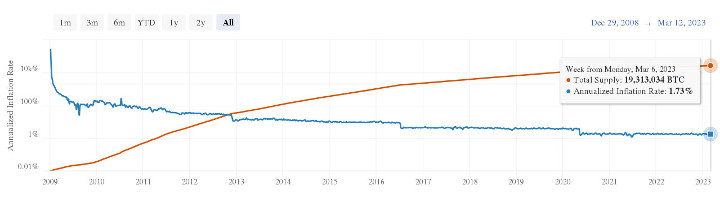

Have a graph to crystallize in your mind what we're discussing ; as above, so below :

As you can see (click on it for a clearer pic), Bitcoin's annualized inflation rate was.. hyper-inflationary in the early days, over 10k percent !! Nevertheless, due to its absolute, unyielding scarcity and its superior characteristics for protecting property rights, it was the best performing asset of the 2011-2020(xv) decade and perhaps all time during a hyper-inflationary period. That history in the books, we'll never again see a higher annualized inflation rate of 2%. Over 19.3 million BTC have been mined to date, which is over 92% of the total possible supply. By the next halving at block 840`000, the annualized inflation rate will be below 1%, for good.

Enforcement of the Protocol

OK OK, so the numbers might look good on paper, but how are the rules enforced and how can you know ? Good question. The Bitcoin Protocol is implemented in open source software, which is freely available to download, read, compile and run. JWRD Computing maintains the most conservative reference implementation along with associated tools such as a Linux distribution and an Airgapped Bitcoin Wallet. A computer running the software that verifies and maintains the complete transaction history is called a node and the people running the nodes are called Peers.(xvi) Since the protocol is implemented in software, who you accept software from matters because code authors and signers represent counterparty risk. V is a tool employable to manage such trust. Holy due diligence is holy due diligence ; in Bitcoin, understanding who you are accepting code from, what their history and reputation is and what their incentives might be comes with the territory. As an example, Bitcoin's rotten core, aka the Power Rangers(xvii), inserted into their softforked version of the Bitcoin codebase an inflation bug in 2016 which was not discovered until 2018. Informed operators hadn't been accepting Power Ranger code since 2012 or 2013 or so and the bug was never exercised. The point is, if you want to be a responsible Peer, learn to evaluate who you are accepting code from.

The Costs of Peerage

That segues nicely to the final point I have to make for now which concerns the cost of running a node and becoming a Bitcoin Peer who verifies the system functions as described, enforces the rules as history unfolds, and can independently receive and broadcast transactions.(xviii) The costs fall into three categories : tangible capital, intangible and intellectual costs.

Tangible Capital Costs

- Disk : a solid state drive is recommended.

- ~440 GB for current bitcoin blockchain + block index.(xix)

- (1 MB / block) * (6 blocks / hour) * (24 hours / day) * (365 days / year) = 53 GB / year max growth

- a 1 TB disk can store the full transaction history of the Bitcoin network at full capacity for about a decade to come.

- RAM : 4 GB is recommended

- CPU : 2 GHz

Intangible Cost

- Power and bandwidth to run the machine(s) and maintain connection to the Net.

Intellectual Costs

- Computer literacy : e.g. verifying cryptographic signatures, compiling, installing and configuring software. Best learned via the Command Line Interface.

- Scholarship : reading far enough to learn who has done what deeds and whose words carry more weight.

As you have perhaps surmised, the tangible capital and intangible costs are relatively low and the intellectual costs are relatively high. That being said, professionals wrap their heads around complex topics as a matter of course. Bitcoin is a nexus of several complex fields, but with dedicated effort and good teachers, becoming competent is quite achievable for the otherwise competent. JWRD Computing offers a Key Management Hardware Kit and Training Program to save select people time in getting up to speed. Compare this to the costs of verifying how much fiats are in existence and not even the central bezzles themselves have the means. You're literally losing time and money by not investing in learning to Bitcoin. So what are you waiting for ? As that Eulora MOTD goes, "The most you can hope for is ending up with the right regrets".

- Bitcoin uses integers to represent numbers. As such, the satoshi is the base unit of account, the numeraire. 1 Bitcoin (BTC) is really just shorthand for 100 million satoshi which was easier to communicate in the early days when the world hadn't yet realized their Zimbabwe moment came and left and Bitcoin was trading at a lower price. That being said, as Bitcoin continues to grow it will become less mentally burdensome to think in terms of satoshis ; for some ahead of the curve, that transition has already taken place. It's smarter to think of your incomes and outlays in terms of satoshis because your math gets easier over time, whereas filthy fiat users are increasingly running out of space on their

brainshandscalculatorscancer phones. Maybe by 2032 people/exchanges will have caught up to MPEx cca 2012. Tbh though, by then, it'll probably be too late for them. Are you them, dear reader ? Tick tock, there goes another block. [^] - There's probably not enough paper to go around either if they all wanted it to hold their worth in it at the same time for whatever reason. You know, only 10% of the FRNs in existence are physical, if we're to believe the Fed's own reporting, which... Anyways, the rest are just digits on a server somewhere, probably at data center in New Jersey or something, lol. "All our moneyz are in teh government's cloud." Quite savage, wouldn't you say ? [^]

- Indeed the greatest competition in human history. What "World Series" in Chiraq* or whatever backwater. "Omaha", pshaw, get real. ___ ___ *known as Chicago before America ended. [^]

- Hash means to chop up. [^]

- Why is it that a slim chance and a fat chance are the same thing, but a wise guy and a wise man are not ? Friggin' English I tell yee. [^]

- Maybe it's easier for you to understand in terms of the difficulty of division compared to multiplication. If I ask you, "what are the prime factors of 13`843`867 ?" that'll likely take you a while. On the other hand, if I ask you, "what is the product of 2`029 and 6`823 ?" You can return to me relatively quickly, with or without your

pacifierphone. [^] - As explained in the Prologue of The Black Swan by Nassim Nicholas Taleb (2007) :

What we call here a Black Swan (and capitalize it) is an event with the following three attributes.

First, it is an outlier, as it lies outside the realm of regular expectations, because nothing in the past can convincingly point to its possibility. Second, it carries extreme impact. Third, in spite of its outlier status, human nature makes us concoct explanations for its occurrence after the fact, making it explainable and predictable.

I stop and summarize the triplet : rarity, extreme impact, and retrospective (though not prospective) predictability*.

___ ___

*The highly expected not happening event is also a Black Swan. Note that, by symmetry, the occurrence of a highly improbable event is the equivalent of the nonoccurence of a highly probable one.[^]

- The plain text version from Project Gutenberg. [^]

- Hey hard work pay off, now I don't take a day off ; I rest not, I guess that's why your best shot ? Way off. These are the things that dreams are made of ; the sweep, no time to sleep when you're 31337. If you know, you know. [^]

- I suppose the March 2023 version would read, "Chancellor on brink of second

bailoutSPECIAL VEHICLE for banks". You know, that freshly minted BTFP* is just BTFD** with one different character, but when you put your "full faith and credit" on a system rooted in Fedspeak "syntax destruction", what do you expect ? Indeed, it's why you can't have nice things and of course the beatings will continue until morale improves. ___ ___ *Bank Term Funding Program aka Buy The Fucking Pivot**Buy The Fucking Dip [^] - Now, while there is no rational way to represent property in yet-unmined blocks, which gives Bitcoin a positive incentive to mine and a huge advantage over gold which has a negative incentive, asymptotes don't exist in nature and aren't likely to be reached with Bitcoin. Whereas with gold, there is a negative cost to carry, Bitcoin finances its security with the block rewards and transaction fees paid to the miners, which is a disaster of the commons situation.

At some point there will be a phase transition where it's more economical for miners to start a new Bitcoin. The first likely step will be to unwind the softforks pushed by the undeclared enemies of Bitcoin to subvert it.

Does your head hurt yet ? Well, it'll subside if you continue trying to understand. Competence means seeing the world how it is, not how one wishes it to be. At least you see now the tint on my glasses isn't excessively rosy. Bitcoin isn't perfect and it's not forever, but, as the man said, "to clean a room you gotta at some point stand on dirty floor". Bitcoin is a tool for cleaning, fiat is a tool for polluting. So, are you cleaning or polluting ? [^]

- Maybe they use Crapple, but really, who cares about the difference between Pepsi and Coke ? [^]

- I have my doubts they're smart enough for alliteration, but let's dress'em up a bit, what could it hurt ? [^]

- I mean, maybe there's a surge of hash and it happens Q4 2023. [^]

- AD didn't start at 0, you know. [^]

- One Peer can certainly operate -- and indeed is encouraged to -- run multiple nodes [^]

- I struggled to link directly to the PRB list item in the article, but didn't end up managing, the comment is a good enough anchor. [^]

- It's like being a correspondent bank, except better. Correspondent banks can't independently verify the money supply now can they ? And all their FRN transactions are under the thumb of SDNY aren't they ? [^]

- The debug.log also grows pretty quickly, but can be pruned regularly. [^]

Updated to add footnotes #7 & #11.

Comment by Robinson Dorion — March 14, 2023 @ 18:24

[...] Put that in your pipe and smoke it. [^]0.00004244 Bitcoin/dollar [^]19`320`337 BTC. [^]Which is 20`999`999.97690000 BTC. [^]Annoyingly, Poloniex is the only fiat exchange available a trading view with Bitcoin as the [...]

Pingback by Happy Saint Patrick's Day « Dorion Mode — March 17, 2023 @ 23:37

[...] Bitcoins come into existence was covered in a prior article. Here we'll discuss how ownership is exercised over the coins and how disputes are resolved if and [...]

Pingback by The ownership of Bitcoin : custody, transactions and dispute resolution. « Dorion Mode — April 4, 2023 @ 21:13

[...] short run until their illegal belief by count runs out of gas. Unfortunately for the socialists, Bitcoin has emerged to crush all this nonsense and flush it down the [...]

Pingback by Inflationary language « Dorion Mode — April 7, 2023 @ 01:32

[...] a Brains tshirt, which I immediately recognized and she confirmed was the company which provides Bitcoin mining hardware and services. Her partner, Javier, has, among other businesses, a facility in Paraguay for [...]

Pingback by I'm not from there, but it's where I was born. on Dorion Mode — April 20, 2023 @ 04:44