This conversation between Peter Schiff and Erik Voorhees changed the course of my life. I had been learning from Peter since January 2010, reading his books and listening to his podcast and 5 days/week call in radio show(i). I started working for Peter Schiff presents Euro Pacific Bank Bezzle in February 2012, which caused me to first move to some Caribbean Islands, primarily St. Vincent and the Grenadines and later to Panama, where I met Erik in June 2013(ii). I understand they've had subsequent conversations, which I've not listened to, but as far as I know, Peter maintains his positions presented below to this day.

I was originally going to keep this rather short and sweet and only highlight and discuss the primary issue I had with Peter's position during this conversation, the point where it became evident he had betrayed the Austrian School of Economics and thus where it became clear I had to cease working for Euro Pacific. As I gave it a listen though, it occurred to me that the times a conversation changes the course of one's life are rather rare, so while we're here, let's go all the way and adnotate the whole thing. Furthermore, bringing the inferior medium of audio into the superior medium of text provides the opportunity to properly reference the points being made and poke fun at the holes in the various positions taken.

Editor's note : the audio is littered with substantial repetition and stuttering. Part of this can be attributed to audio being communicated over a blocking(iii) channel and thus, when, one's attempting to gain control of the channel, interrupting occurs until the speaker gains exclusive control of the channel via the silence of the other party. I was originally going to leave in the stutters, repetition and verbals ticks of the speakers (Peter was the primary offender), but I later decided to edit them out to make it easier to read and re-read, for both myself and you, dear reader. Thus, it's not word for word, but every effort was made to retain the meaning. It took place December 2nd, 2013 and was pompously titled, "The Ultimate Bitcoin Showdown", the video/audio is available on USG.Google presents video.

PS : Joining our program now is Erik Voorhees. Erik is a writer, entrepreneur, bit(iv) of an economist he's also an early Bitcoin adopter. Used to work with a company called Bitinstant(v), now he's with a company Coinapult(vi), which I'm sure has something to do with Bitcoin(vii). Erik welcome to the Peter Schiff show.

EV : Thank you Peter it is a great privilege and honor to be here speaking with you all.

PS : Right, let me congratulate you on being one of the early Bitcoin adopters, I'm sure you're sitting on a small or large Bitcoin fortune(viii) at the moment ; the question is, what are you doing with it ? Are you are you buying ? Are you selling ? What do you do with all your Bitcoins at this point ?

EV : Well I use Bitcoins in the same way that anyone would use you know any form of money. I gather them when I perform services for people, I save them, I spend them on things and I use them for a form of savings and means of transaction, I receive my salary in Bitcoin. So, yeah, I'm in it pretty deep.

PS : So, you're paid a salary in Bitcoins ?

EV : Correct.

PS : What, is your salary fixed in Bitcoins ? So, if Bitcoin goes up you just make more money ? Or does your salary get adjusted ?

It wouldn't be more money, 1 BTC is 1 BTC(ix) or 1/20`999`999.9769 of the total potential money supply. Thus, the correct way to describe the situation would be to say, "to make more or less purchasing power".

EV : As you know Bitcoin is very volatile. So, people that deal with Bitcoin just use a value, you know, in dollars or whatever your salary might be and then you just convert it into Bitcoin at the time of payment so it makes it very easy all.

Some "people", actual Bitcoin companies listed on actual Bitcoin exchanges pretty much always referenced the BTC in their offerings and reports nothing else.

PS : Right, all right, so, you don't have a salary negotiated in Bitcoins. Where, okay, I'm getting 10 bitcoins a week or one Bitcoin a week. You have a dollar salary and then when it's time to pay you, your employer figures out how many Bitcoins would be needed to equate to that amount of dollars and that's how much you get.

EV : Correct because it's using Bitcoin as a payment network instead of necessarily as a currency.

PS : Right, in my opinion, for it to be actually a currency, your salary would be in Bitcoin ; it would be fixed, you would get your salary, ten Bitcoins a week, whatever it is, and that's what you would get. Regardless of whether the Bitcoins were worth, ten thousand dollars or fifty bucks, you would get, that's what you would get paid. Which, of course, is difficult because you can't work under... Yeah, you would quit if they went down, right ?

While I understand Peter is trying to make a point about how incentives affect behavior, this point about quitting when the chips are down is perhaps more a reflection of him rather than humans in general. The workers at the top of the food chain work for equity, whether it be represented as warrants or options or straight stock. They weather the storms of the market if and when the longer term value proposition of the project is maintained, i.e. they invest. They organize themselves to keep their word.

EV : Let's say I worked for Euros, but my company paid me in Dollars and just pegged the amount at the time, at the exchange rate of Euros at the time of payment. Does that mean that Euros is not a currency just because I'm using something else at the time of the transaction ?

PS : Well, I mean, most, I know a lot of people that do work in foreign currencies and if they're getting paid in Euros, they get Euros. I mean they don't have it, what we'll pay you a Dollar equivalent. I don't know anybody that works under that, because everybody I know that works overseas, they're getting paid in whatever that currency is or they're getting paid in Dollars, but, the variability between the Dollar and the Euro, on a daily basis is going to be quite small. I mean, if the Dollar and the Euro exchange changed by one percent against each other in a given day that would be a big move in the forex market. Whereas, the Bitcoin market, Bitcoins, just in the last 24 hours, the difference between the high price and the low price is at least 25%. So, you have, much bigger variances in Bitcoins that you would with, Euros or Yen or Dollars or pounds or any of these other fiat currencies.

I appreciate Erik's Socratic approach. Peter deflects a question rooted in principle, argues from ignorance and changes the subject to volatility. Derp.

EV : Yeah, absolutely no one's going to argue that Bitcoin is not volatile, but what's important is that it is becoming less volatile over time. So, three years ago, I mean, it would move in the order of 100 or 200 percent in a day, very easily. Over time, as the market grows and as the base of usage widens it's going to stabilize, just like a small stock is more volatile than a large stock or a small national currency is going to be more volatile than than a large one. Indeed, silver is much more volatile than gold because gold is a bigger market so it's the same principle.

PS : Well, I don't know, how you necessarily can abstract that and think that there's going to be less volatility in Bitcoin. I think that there's actually going to be more volatility. I don't think the volatility is just going to go away as the price goes up, but you know one of the main problems, I think, when you try to look at a Bitcoin versus, you know, gold, because people are saying, "Well it's just a new version of gold," you know, for hundreds of years, maybe more, before gold was used as money, it was already used, it was an acceptable, highly coveted, valuable commodity that people wanted. It eventually became used as money because it was a more marketable commodity than other commodities that were used as money in addition to gold. So, gold just became the commodity that was best suited to also be money, but it was first and foremost a commodity, a luxury good, that was in demand all around the world. The thing with Bitcoin is nobody wanted a Bitcoin until it was invented for commerce. The sole purpose of Bitcoin is to use it as money, but it doesn't have any value absent being a medium of exchange.

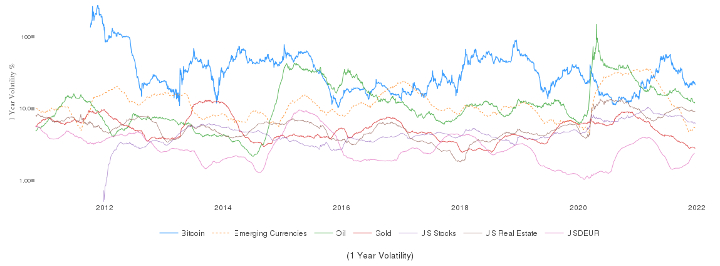

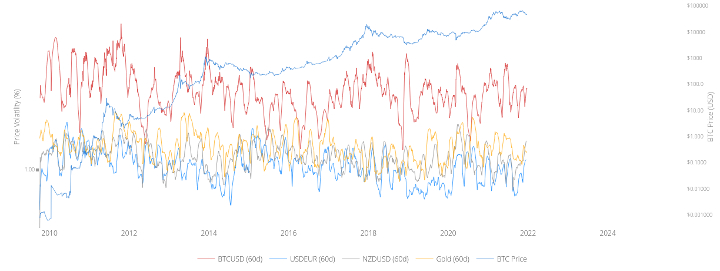

The diminishing volatility point was both true at the time and has remained true as Erik described. Peter doesn't address the principle and instead claims it'll turn out otherwise, but instead of explaining why he then changes the topic from price volatility to value and erroneously claims Bitcoin doesn't have value outside of medium of exchange. Before we delve into that, here's some charts on Bitcoin volatility and Sharpe Ratio :

Above, 1 year volatility (source) ; below, 60 day volatility (source). On the 60 day volatility chart, the volatility scale is embedded in a JavaScript tool-tip rather than listed on the left hand side. To give you an idea, the peak in October 2011 clocked in at 84.4%, while the 2021 peak of measured 27.4% and currently we're currently at 13.18%.

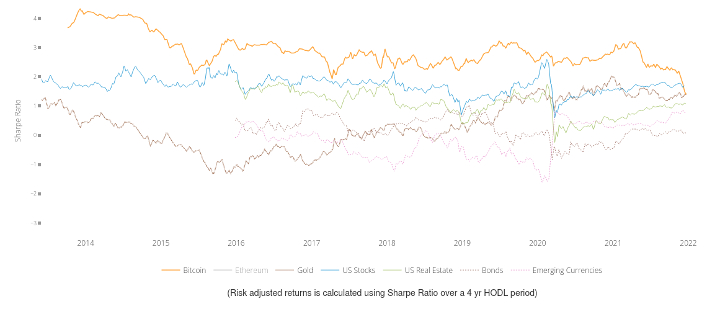

Apart from Oil going negative in Q2 2020, Bitcoin has been more volatile, but that volatility has diminished substantially as more liquidity has entered the market. That being said, the cost managing the volatility risks come with a reward as the chart below shows Bitcoin's 4 year Sharpe ratio(x) has been beating pretty much everything else, at least in that list which included Peter's coveted gold.

Now, to address, "Bitcoin doesn't have any value absent being a medium of exchange," perhaps it doesn't have value to him, but that's more of a reflection of the quirks and limitations of his personality than value per se. Indeed, several people, starting with Satoshi himself, valued Bitcoin enough to act on writing the software and fixing the software and contributing computing resources to solve the contrived mathematical puzzle Bitcoin proposes(xi) prior to Bitcoin being used as a medium of exchange at 10k BTC for a coupla pizzas some months later. Thus, even if the Misesian monetary regression theorem is correct(xii), I don't reckon Bitcoin violates it. Furthermore, Mises points out that once something is used as money, a substantial part of the demand of that something is for its use as money. The fixation on medium of exchange also ignores another of money's important characteristics, store of value.

EV : Right, so this, I think, is the point that, is most bothersome to you and so, I think we should take a little time to explore this. What you're missing when you say that Bitcoin has no value is that you're looking at Bitcoin, just as the currency unit, instead of looking at Bitcoin the payment network. If I was to tell you that I had created a decentralized payment network that could send transactions between any two people, in any size, anywhere in the world, without any government knowing about it, or any fee, or any counterparty risk whatsoever, would you say that such a system has no value ? And then, if I told you the best system only accepts one currency on it called the Bitcoin unit of currency, very clearly the Bitcoin unit of currency is going to have a market price because there's only so many of them on that network.

The "with out any fee", aka free transaction, angle was always weak. Even if transactions with zero fee were being included in blocks when blocks were small and Satoshi Dice was doing 25% of the volume and being chastised by idiots like Luke-Jr for "spamming" the blockchain, transactions were never free. At minimum one had to run a node to broadcast transactions, which carries a nonzero cost in both human and physical capital. If one was not running a full node, one was incurring counterparty risk, whoever claimed to be running a full node from which you were getting your transaction information could have been giving you bad data, as e.g. blockchain.info was caught doing. Even if you're cross referencing from multiple third parties, there's a) your time and b) still the chance you're being Sybil'd. It turns out the false assumption of "free transactions" was not free either, as dudes like Roger Ver found out a couple years later during the block size war when they put whatever reputation capital they had left in the sinking ship of BitCHcoin Cash.

It's also false to say Bitcoin transactions are free of counterparty risk. I think the mistake is conflating "no trusted 3rd party" with no counterparty risk. Anytime you buy something from someone with Bitcoin, either you front the risk by sending the money first and hope they'll deliver whatever you're buying or they front the risk, send you the thing and you pay them cash on delivery.

PS : Right, so, I would have to two questions and we'll have a break and you can come back and answer them. The first one I would have to do is, if I accept the idea that the payment system has value and is an interesting or valuable system there, either there are no barriers to entry, there is nothing that prevents five, ten, a hundred alternative competing digital currencies that have the exact same properties, you know, as Bitcoin. So, you can have 21 million Bitcoins, but you can have hundreds of billions of other digital currencies that could circulate that can go on a different network. And you never know, maybe at some point the networks could all merge and, you could have people that will say, I'm going to take payment in any one of a hundred digital currencies, just like well, are you going to pay in Visa MasterCard or American Express. It could be Bitcoin or whatever other coin you want to make up.

So that's my first part and my second part is, when you talk about there's no costs in the transactions, that assumes that both parties want Bitcoins and only Bitcoins, because if I wanted to use the Bitcoin network to buy something and I wanted to use it simply as a payment mechanism, but I didn't have any Bitcoins right now, I had Dollars and the person who was selling me something didn't have, didn't want Bitcoins, they wanted Dollars or Pounds or Euros or some other currency, by the time I take my Dollars and convert them to Bitcoins, yes, I can send the Bitcoins for free, but I've incurred a cost to buy the Bitcoin, now the seller of whatever object he sold now incurs a cost because now he has to take those Bitcoins and sell them and get cash. And now what is going to be the difference between the money I spend to buy them and what the seller receives when they ultimately liquidate ? There could be a big difference there, could be five or ten percent, twenty percent difference there, could be a much bigger loss then, you know, the fraction of a percent or maybe even one or two percent that could be lost in international multi-currency transactions, where the currencies are far less volatile than the Bitcoin. Yes, if the Bitcoin volatility eventually goes away, which is a big if, then that might not be the case, but certainly today, given the massive volatility, you can't really use Bitcoins as a low cost payment system.

There is no fraction of a percent or two involved when you count the real costs rather than simply the nominal costs. For example, to have a Bezzle send your money, you need to give them all your government issued docs, the definition of which continues to become more burdensome. First it was drivers license, then proof of address, then you had to share the banks' politics and I wouldn't be surprised to see it creeping towards medical records, proof of recently government administered anal swab COVID tests coming soon ! By now, with FATCA and CRS, these bezzles are giving up info to the nanny state as a matter of course. They could always practically get at it, since SSL is a transparent fraud. On top of that, you either have to go the Bezzle office in person or load their shitty website(xiii) that'll only work on the latest and greatest Internet Explorer/Google Chrome/whatever. Yeah, anyone with a clue knows you can try to spoof the browser agent string, but in many cases the online banking shitstack remains broken. And don't even start with, well you can just install the appstore app on your tvphone. And on top of them leaking your information in the normal course of their business racket, they can and will freeze your account steal "your" money on a whim. So, fuck you one or two percent.

If you consider Peter's coveted gold, the transaction costs go up as the transaction values go up. That is, while you might be able to walk around with a couple dozen ounces in a briefcase, you have to finance an army or at least armored trucks to "send a transaction" as transaction values increase. Bitcoin network fees are determined by the size of the transaction in terms of data rather than coin count, i.e. transactions with more inputs and/or outputs require more bytes than transactions with fewer inputs and/or outputs. Network fees are not the only transaction costs in Bitcoin as key security is not free. However, guarding a 256 bit number against theft and leaks is a lot less costly for the informed operator compared to guarding duffle bags of Benjies or stacks of metal.

PS : And so Erik, first of all, address my concerns about competition and barriers to entry.

EV : Sure, so that's an excellent point and it's true that the Bitcoin network could be replicated, in part, by anyone because it's open source code. So, anyone can copy it and make a new one, but the problem with networks is that they require Network effects, so there's a reason that there's only one email protocol in the world right now and when you send email to someone you're both on the same protocol. Anyone could take that protocol and make a new email protocol, right, but why are people going to switch ? There's no added benefit to switching. So, the fact that Bitcoin had to struggle with this network effect in the early days was a challenge, but now it's becoming one of its strongest attributes. Any of these other cryptocurrencies would have to offer something far better than Bitcoin in order to compete.

PS : Well if you go to this website coin market cap dot com, they list, basically, 42 digital currencies. Bitcoin is at the top of the list by market cap, but I don't know that, you know, there's all these other currencies that are already out there. I mean, they might not, be carbon copies of Bitcoin. They might have slightly different features, some maybe are not as good, some maybe are better. I mean, I don't know, but one thing I would think of is that people might look at well gee Bitcoins are very expensive now, there's a lot of risk, why don't I just buy one of these other digital currencies that still lower price, that might have a lot more upside potential. I mean, Bitcoin could be a victim of its own success in that the more expensive it gets, the higher is the perceived risk and somebody might want to buy one of these other coins, that they can still buy for like less than a buck apiece and they hope, well maybe that one will become the next Bitcoin and, you know, that one might have a better chance of going from 1 to 100 then Bitcoin has from going from a thousand to a hundred thousand.

EV : There are a lot of silly speculators that would make that exact argument that Bitcoin is too expensive so I'm going to hop onto one of these smaller ones. What those people seem to forget is that the reason that Bitcoin is expensive is because it actually has the infrastructure that makes it that valuable. Bitcoin is the one cryptocurrency that has thousands of businesses around the world working on building systems for it. It's been around for the longest amount of time, it has the largest mining network that keeps it secure, it has all the tools that the others don't.

Peter, as is becoming more and more evident, continually talks to his Joe Blow, cut off tee shirt wearing target audience. What, penny stocks are the way to go because blue chips are all of a sudden too expensive ?(xiv) People with money simply hope as if they're buying lotto tickets rather than do their due diligence and invest ? Get outta here.

Anyways, 42 digital currencies listed in December 2013, fast forward to today and there are over 15k listed there, which Trilema readers will recall was noted as the most likely outcome in February 2013.

While Bitcoin has ceded some share of the market cap, market cap is a superficial measure. Value normalized for liquidity is more important than market cap and by now Bitcoin liquidity has invaded all markets on Earth worth the mention. At best altcoins are useful for lower value transactions not worthy for inclusion in the holy blockchain(xv) and mining of price volatility to stack sats. Altcoin speculators are still much better served measuring their risk, rewards and return on speculation in terms of satoshi and furthermore converting to satoshi when they're in search of dollar liquidity, whether it be tide or bezzle.

PS : Well, it's been around for, it's been around for four years. I mean, that's not that big a jump and is it that much difficult ? And if I'm a merchant and I accept Bitcoins, is it really that much harder, is it really that much more difficult for me to also accept Litecoins ? I mean, once I've made the investment and decided to accept Bitcoin, I mean, how difficult is it for me to say I'm also going to accept Litecoin ?

EV : It's a great question. So, our company Coinapult, we do do some processing for various companies like this and we've had a couple people ask us if we would start doing Litecoin. And while we've considered it, you know, and we probably would do it, if the market demand was large enough, the infrastructure is just not there. So, the tool that we use to provide services for Bitcoin just don't exist with Litecoin now. Maybe they will in the future, but they don't now. Meanwhile, Bitcoin is growing faster than all these others because it has a network effect of all these people building it. We just aren't dedicated to any other because Bitcoin is the winner.

Peter's thinking of four years in terms of fiat time, where some bureaucrat decides when he and "his" employees will work and they have Saturdays, Sunday's and a few holidays a quarter off(xvi). Bitcoin doesn't sleep and is in fact a representation of time itself, the heartbeat of the immutable machine backing the global market, i.e. the real market out of reach of any bureaucrat. To measure the difference between fiat time and Bitcoin time mathematically, there's reportedly 261 working days in USia. So, even if you overestimate and say people are putting in 10 hours/day of solid work as opposed to the makework they busy themselves with, that's 2610 hours per year. Bitcoin is always working, 365*24 = 8760 hours. Therefore, 1 year of Bitcoin time is over three and a third of fiat years since 8760/2610 = 3.356. So, Peter's claimed 4 years should be normalized to 13.425 years to get a clear picture.

PS : Well, it's winning for now. I mean, we know that, you know, there are a lot of these early adopter, you know, first mover stories when it came to the dot-com space, and, you know, a lot of the first movers were first to go bankrupt. It didn't necessarily mean, just because they got there first, didn't mean that they were the winner. There were companies that found out what they were doing wrong, they improved on it. I mean, for example, I'm already starting to hear now about digital currencies that would be backed by gold, which would make them more of legitimate currency, more of a replica of the original paper currencies that were backed by gold. And so, don't you think that if now, if the whole idea about a digital currency catches on, if you have digital currencies backed by gold or backed by silver, don't you think a digital currency backed by something real might have a lot more appeal to people because it would be a lot less risky than a digital currency that's backed by nothing ?

EV: So, let's first of all, let's not be scared of competition, right ? If Bitcoin fails because a different cryptocurrency is so much better that it takes its place, we all still win anyway. This is, this is great for anyone that's not speculating on the Bitcoin price as an investment, but that's an inherently risky proposition anyway and no one's going to receive that. Regarding the matter of a gold cryptocurrency, first of all this has been tried twice, at least twice. First, E-Gold tried to do it, they were shut down. And then Gold Money had a system where you could send payments of gold between different account holders, they had to shut that off because of regulation and E-Gold are shut down because the government's don't like decentralized payment or they don't like payment systems that don't use the banking system and they don't use fiat. So, any gold based digital currency is going to be shut down because it requires backing, which requires a backer, which is counterparty risk and that counterparty will be shut down as soon as the system gets over a certain amount of size. The reason why Bitcoin is so special and so amazing is that there's no party that can be shut down as it grows, so it's free to grow all the way up to it's potential.

More legitimate in the gold bug's narrow, Linuxless(xvii) mind only. The controlling article here is, How many years you got ? That is, whereas with gold, capital must be risked to mine the new supply and a troop of soldiers must be paid some unit of gold per some unit of time to guard it once it's above the ground, Bitcoin is secured by... the miners. Furthermore, the defense of Bitcoin keys and the transferability of units broadcast over the Internet make Bitcoin much more costly for thugs to steal, whether they style themselves as "government" or "the state" or they abstain from styling themselves at all.

Apparently it doesn't occur to Peter that gold failed already as a currency, he'd probably quote some Alisa Rosenbaum and say the people failed gold. However, the percentage of the population then that was actual people was much higher than the modern, zombie polluted environment. In some perspectives, it's unfortunate that it's the case gold failed, but if gold hadn't failed as a tool to fight the state, the 20th century would've been much different. To my mind it's not worth pondering alt-histories where gold didn't fail. Gold did fail and the statists stole it all and that's why Bitcoin is here slay what the state has metastasized into today.

PS: Well, if the government wanted to crackdown and, I'm not sure, you might be able to come out with a digital currency that would be AML compliant and the government would be satisfied that you were compliant ; but, if the government did want to crackdown on Bitcoin they could certainly make it illegal for merchants to accept it. I mean, certainly, in the United States, for example, they could say you're not allowed to accept them and they can punish it. So they can certainly do that and they can look on the Internet, they can certainly find the traffic in Bitcoin and they can punish people for using them or they can make it prohibitively expensive to use it. They can require all sorts of information and record-keeping before you can accept a Bitcoin. So, there are certain ways that government, if they want to track, crackdown on Bitcoin, Bitcoin isn't immune from governments.

The issue with making an AML compliant currency is the most important characteristic of a functioning currency is fungibility. When a currency becomes AML compliant it is no longer a functioning currency empowering the people to fight stupidity, but it instead becomes a tool of the stupid bureaucracy, but I repeat myself, to fight the actual people as they carry out their legitimate affairs.

Sure, through their stupidity they'll end up giving the billions upon billions of increasingly worthless dollars worth of overpriced arms to the very terrorists in question. The ones had allegedly been fighting and using said fight as pretext to take away more and more of the freedoms they claim to be fighting for in the first place against they terrorists they trained and armed from the beginning. The recent gifting of billions in weapons to "terrorists" isn't anything new. You know, like Osama bin Ladin was a "freedom fighter" back in the 80s when he was financed by the swamp to fight the Soviets.(xviii)

Peter well knows the government isn't capable of keeping drugs out of prison and is against their criminalization, at least that's what I've heard him say. So, what, they're going to be that much more successful in preventing people using math and electricity to communicate value ? Furthermore, he well knows about Roosevelt's Executive Order 6102 making gold illegal, so how this whole confiscation by big bad government makes gold look any better than Bitcoin is anyone's guess. I suppose this is what you call cognitive dissonance.

EV : Sure, sure, but let's remember that that when you're talking about government, it's not just one government. It's not just the US government to control the world, right ? There are over a hundred different governments around the world and all have various policies. If the U.S. taking a hard-line stance on Bitcoin and actually tries to get it shut down, there are other competitors to the United States that would be more than willing to allow all the innovation and technology and investment that's going to Bitcoin to come to their shores. We're already seeing this with China, which currently has the biggest Bitcoin market of them all.

The controlling articles concerning the ability of states to regulate Bitcoin are Stage n: Bitcoin exists and, The future of Bitcoin regulation.

What Peter fails to see or accept is Bitcoin waging a war of attrition and has the power to fight back. While ransomeware was perhaps not very prevalent in 2013, it is now and agents leveraging Bitcoin's power have shown they can shut down major infrastructure, e.g. Colonial Pipeline, etc.

One caveat I'd raise about the "hundreds of governments" argument is that the war being waged using the SWIFT system and correspondent banking network indeed indicates there are not over a hundred different governments with various policies, not when it comes to money at least. Even Switzerland, which claims to have not been invaded in quite sometime, indeed changed "their" laws when faced with external pressure from the poor hoards abroad. When given the decision between sovereignty and Dollars, they chose Dollars. When confronted with the decision between a strong Franc and a watered down Deustchmark, they chose to peg to the watered down Deustchmark colloquially known as Euros.

PS : Erik, the same thing can be said for legitimate, gold back digital currency. If some company in China were to launch a gold backed digital currency, the US government couldn't do anything to stop them. They could still launch it, those notes could still circulate online. My point is, if you have a currency backed by something, then you don't have this, like this situation, where you would enrich a handful of early adopters and then people that come in later take a tremendous amount of risk that the bottom could drop out of the market. If you have a digital currency back we got record...

What Peter is eliding is that, indeed, he's an early adopter of Gold. Publicly he talks about starting to buy at $200 at the turn of the millennium. However, his father was well known precious metals person. There's a story of ol' Irwin going to grocery stores in the 60s and swapping out the silver quarters in the registers for the nickel plated copper quarters that were swapped in after 1964. I recall Peter talking about having bags of junk silver lying around his house, some of which were probably left over from Irwin's scores.

EV: Peter you've got that backwards.

PS: How do you mean.

EV: The people that took the risk are the ones who got in early...

PS: HAHAHA

EV: ...the ones who started using that before anyone was giving it any attention at all. They were the people that spent their money, their time, who did all this work before anyone was paying any attention to this and now it's on every major news channel and everything and the benefit is clear, it has far higher infrastructure than in those early days and now people are buying it so it's far less risky now.

PS : Okay, I don't understand how you can make the point that the risks are lower today. Let me give you an example of what I'm thinking, so, let's say, you know, four years ago, somebody put 50 bucks into Bitcoin. Um, yeah, you know, they could have lost the entire 50. I mean, they could have gone to zero. They really didn't know what was going to happen, but they took a flier on $50 and they put them into Bitcoins and let's say now those coins are worth a million dollars, right ? Um, if somebody were to buy those Bitcoins today for a million dollars, the Bitcoins that the seller paid 50 bucks for, even if I would agree that I don't think Bitcoins will go to zero, maybe they'll only go down 90 percent. Let's say, maybe I don't think they can go to zero, but, you know, to put a million dollars on the line and potentially lose 900,000 compared to the guy taking a flier on 50 bucks... and is the guy that's putting in a million dollars is it going to become 50 million or 500 million ? I mean, you have to look at risk versus reward. When people were buying Bitcoins when no one heard of them and they were kind of obscure and it was like kind of like a punt and if it worked out you could make a fortune and if it didn't you didn't lose too much, I mean, it, maybe it was a gamble worth taking. My point is, today you have to spend a lot of money on those Bitcoins.

EV: Yes, I think that putting a million dollars into Bitcoin is riskier than putting 50 dollars into Bitcoin four years ago. Of course, you're right. Spending that kind of money is going to be riskier than spending 50 dollars, but the more important point is if someone put in $50 four years ago, is that more or less risky than putting in $50 now ? I would say it was far more risky to put in $50 back then because the system was far less tested and developed. Now it's actually running a like a payment network, it's moving billions of dollars every single day.

PS: But not if you, if you weigh in relationship to the reward, you might say that it was worth a 50 dollar flier back then because of all the potential. Unless you believe that the upside is still as great now that the appreciation potential is still there that the guy that puts 50 dollars in today can have a million dollars in four years, unless you think if that's still possible that it's always a risk reward because you don't know what, go ahead ....

What a ridiculous approach by Peter and good on Erik for calling it out. A main argument for why there was less risk in the system by late 2013 is covered in Things that matter these days ; things that don't matter these days ; i.e. by 2013 ASICs came online and Bitcoin became the global leader in computational power and thus solidifying the security of the network.

As far as scoreboards go, my price charts say BTCUSD closed at $1,190.80 on December 2nd, 2013, i.e. the day this conversation was conducted. Meanwhile, XAUUSD closed at $1,219.30. So, someone putting $1M on each that day(xix) would've picked up about 840 BTC and about 820 ounces of gold. Fast forward to today and BTCUSD is trading at about $48k and meanwhile XAUUSD is struggling to break above $1.8k. So in BTC that $1M turned into $40M and in Gold that $1M turned into $1.4M, i.e. it didn't even keep pace with dollar money supply growth, aka inflation.

EV : But let's change the topic a little bit because whether Bitcoin is a good investment or not is not really the interesting question. And whenever I talk to people, I say that it's an extremely risky investment, it could absolutely go to zero and the whole thing is completely experimental right now. So, I'm not here to say that Bitcoin is a good investment. What I'm here to say is that the Bitcoin payment network is one of the most important technologies that has ever been invented and it's important to understand that there is value in that technology. It's important to understand why that technology is so useful for people, especially people who care about Liberty around the world and if you understand that, then you can realize that the coin has some value. Maybe, it's maybe 10 cents, maybe it's a dollar, or maybe it's a million dollars, but the specific price is not important. What's important is the system itself and understanding why it's...

PS : I agree with you about that, but if you're going to say that it's money, see, that's the problem. People are going to say that it's money, that it's an alternative to gold when the future value is so uncertain. I mean, yes, I don't know with any degree of certainty what gold is going to be worth next year. I mean, I can't know that, but I do believe it will be valuable. I don't believe it will be worthless, I don't think the chances... that it's going to have no value, but with Bitcoin the unknowns are so great that it can't be money right now. You can only view it as a speculative asset and then the question is maybe it could be money in the future. Right now, it's a highly speculative asset, not, you know, but we don't know where it's going to be and I agree with you that there could be a lot of value in the payment system, but if it's not proprietary, if it's not protected by patents, if there can be hundreds or thousands of identical coins that are circulating around, then the potential supply of digital currency is not 21 million it's unlimited. And if all Bitcoin has is that it was first, you know, I don't know, you know, is Bitcoin is it MySpace or is it Facebook or do we even know if there's something else that's going to out Facebook Facebook ? I don't even know that people are going to be using Facebook in ten years, you know, we don't know that.

EV: Again, let's not, let's not worry about competition. Competition isn't something we need to be scared of.

PS: If you're talking about limited supply it is.

EV: The point is, it's leaning into competition, but that's because of certain properties it has. It has the largest network of miners, which means that it is the most secure network. If you care about the trust of the network and then the fact that it has the most miners is very important and even though you can copy the code you cannot copy that infrastructure. That's millions or even billions of dollars worth of infrastructure that cannot just be copy and pasted, so while the code is open source, you know, you don't need a patent to protect the infrastructure because the infrastructure is real and cannot be reproduced easily.

For all his Libertarian claims, the proof of what God he worships is in the patent pudding from my perspective, as if nobody ever won in the market without a patent. The difference between gold and Bitcoin in 2013 was that while gold's price might've had more stability, it was pretty clear it that it had already failed once and wasn't going to return as a means of settlement anytime soon ; whereas while Bitcoin's price was a lot less certain, one's ability to settle payments with it was self-evident.

For further context on Erik's comments about the strength of the mining network and the incentives this strength carries, you're going to want to read The woes of Altcoin, or why there is no such thing as "cryptocurrencies". Bitcoin's mining advantage has only grown, not only in the context of other alleged cryptocurrencies(xx), but in terms of computation generally.

PS: Well how much does it cost how much does it cost to create the infrastructure ?

EV: Haha, well that's what we've spent four years building. I mean it's been it's been probably billions of dollars at this point and it's been countless hours of time.

PS: Well, billions of dollars !! How can, who spent, what do you mean billions of dollars ? Who spent billions of dollars developing the infrastructure ?

EV: If you calculate all the time of all the entrepreneurs and all the people building the equipment and writing the code and all this stuff, I mean, that's going to get, that's going to reach a billion dollars really easily.

PS: But all of that infrastructure and all of that code can be used to support other digital currencies it's not like, it's you know, I want to start a competing currency, I wouldn't have to start from scratch. We wouldn't have to really reinvent the wheel.

EV: Sure, some of it certainly can, but not all of it. Look again, I'm not here to tell you that Bitcoin is going to be the winning currency in a future and thus it's a good investment. I'm here to say that cryptocurrency is an amazing technology. If you just understand why that payment system is very useful, yeah, then it won't be hard to realize why there's value in it.

Most of the altcoins in those days indeed forked Bitcoin's code directly, time has showed Erik's point carried more weight, even if he personally ended up throwing his weight behind creating liquidity in the altcoin market.

I don't doubt "AMAZING COMPANY!" echoed in the heads of readers of the forum logs upon reading, "cryptocurrency is an amazing technology". Lolz.

PS: I think, I think the ultimate way for it to win is to marry the cryptocurrency technology with a gold backing. So that you digitally replicate the original paper money that was backed by gold. When they first came out with paper money, they didn't just say, "Hey take, use this paper it's better than gold, it's easy to use, it's not backed by anything, it's just a piece of paper, but let's just use it and we'll agree to limit the amount that we print." You know, what gave the paper money value, even though it was easier to use than the gold that was stored at some vault somewhere, what gave it value is that people knew that gold was stored in that vault. They knew that they can always get the gold, it wasn't simply depending on somebody accepting it. So right, what gives Bitcoin value ...

EV: But you know who else can get the gold ?

PS: Excuse me ?

EV: You know who else can get the gold is the government. If the government doesn't like what you're doing, they will take the gold. Gold having a physical property can be an asset, sure, but it's also a liability if things go a certain way.

PS: What you're telling me that there's no way....

EV : This is why Bitcoin is not going to compete with gold, it's just a great compliment.

Seriously, Peter is so attached to gold he willfully blinds himself to its demonstrated failings. Furthermore, Bitcoin isn't backed by "nothing", it's backed by math and this mathematical backing is its greatest strength because it increases the cost of theft.

PS : There's no way that the government, with all their technology and all their computer power and all their capabilities, if they wanted to wipe out the Bitcoins, do you tell me now there's no way that they couldn't just wipe out something that exists. They couldn't find a way to disrupt the Internet or disrupt the code and do something and just get rid of it I mean, it's impossible to do that ?

EV : How well have they've done with the drug war ? How well have they done stopping file-sharing from occurring ?

PS : Well here's the thing though, but in order to get my drugs, right, they have to actually find the physical drugs. How do you know they can't come up with some virus that they can put into the network, that's going to search out Bitcoins and destroy them. I mean, I don't know, right ? They said that Titanic was unsinkable. To say that, well, the main benefit of Bitcoins is that government can't screw it up, how do you know ? I mean, there's one thing that government does well and that's screw things up.

EV: Yeah, that's that's very true. I'm not, I'm also not saying that Bitcoin is invincible or that it will never fail and, as I mentioned before, it's extremely experimental, but that's the point. This is a massive experiment to see if we can privatize money in a digital form realizing and if we made it a digital money that was backed by something, that is a central point of failure and people have tried that. I mean, E-Gold and Gold Money already did this.

They tried, boy did they try, y gracias a dios MP por MP. Whether Erik knew it or not, he enlisted in their efforts and helped carry out the agenda to subvert Bitcoin. He says he stopped pushing for the "Segwit 2x" hardfork after Luke-Jr's Segwit softfork attack was accepted by miners. One would think, after all the attacks he took from Luke-Jr, any code written by the idiot would be a non-starter, but I suppose that's part of the downside of being nice.

PS: Well, I know they have. That doesn't mean that they can't get it right because the thing is that what you have to accept then is that you can have money without any value other than it's being valued as a unit of exchange. I just don't know that you can have the money that has no value to anyone other than a unit because now I have people that are telling me, "well, you know, it's no different than gold," that, "there's no such thing as intrinsic value," and, you know, in order to justify Bitcoins, you have to say that, "well we never need anything, we know we money can just be a piece of paper as long as you limit the supply, that as long as you put a finite limit on the amount, that there is, that anything can be money, even if it's not no use whatsoever or no value."

EV: It's not just a limit on Bitcoin that makes it valuable. That something is scarce doesn't it make it valuable, right ? Purple colored cactuses are scarce, it doesn't necessarily mean they're valuable. What gives the coin value is that it is scarce and useful because it has this payment network. Once you understand the peanut. Right, if you've ever did. I mean before the show Peter I just sent ten cents worth of Bitcoin to your email. I don't know if you've seen it but I sent that to you. You can't send me ten cents with a credit card or with PayPal because the fees will eat it up. You can't send me that with gold because a it is still gold.

Peter's strawmen are pretty fucking grating. Who in their right mind would say Bitcoin is no different than gold ? It is different, that's why it's kicking gold's ass in the market. Equating it to paper is also ridiculous because restricting the supply of paper fed to the money machine isn't cheap whereas restricting the supply of Bitcoin is inherent to the algorithm.

You know what the last straw was for me with Peter ? The selective amnesia of Austrian economics. That's when I knew without a doubt I had to leave Euro Pacific Bank. The whole basis of Austrian economic theory is subjective value and marginal utility, that value is not inherent to things, only people and people impute value into things through their actions. Furthermore, a main takeaway for the Misesian monetary regression theorem is that once something becomes money, a substantial part of the demand for it is a function of its use as money.

I'll note here that while my studies of Austrian economics first lead me to Euro Pacific Bank and then lead me away from Euro Pacific Bank by providing me a framework to consider and appreciate Bitcoin, my studies of Bitcoin helped me realize weaknesses of the leading names of the Austrian school, from Mises to Hayek to Rothbard. So, whereas my 2014 and prior self would've recommended you titles from those names to learn about economics, today I'll recommend, A complete theory of economics, The problem of too much money, Let's dig a little deeper into this entire deflation "problem", Digging through archives yields gold, Whoever said resource allocation is a solved problem deserves a kick in the nads., et cetera, et cetera.

Oh, there's also the point that intrinsic value is a result of intrinsic utility.

PS: Right, but I can only spend it, I can only spend it if the person who's selling something wants those Bitcoins. If they want dollars, then I'm gonna have to go through a much more cumbersome process, but the other point Erik is, I agree with you that that payment network and that system may have value, but when you say that it can be replicated and other companies can have it, I, uh, you know the question is, what is it worth and is our Bitcoins worth a thousand dollars apiece ? Or are they worth a hundred dollars apiece, we don't know. You don't know the answer to that question. They could be worth ten thousand dollars apiece since we have no idea. Then at this point, anybody who buys it, it's not like, "hey I'm putting my money in the bank and I have a currency I can spend," I am buying a highly volatile asset that could collapse in price or may go way up I don't know.

Apparently Peter has never seen Mark Dice's experiments offering Calitards bars of silver and ounces of gold, e.g. a) If you guess the value of this 100 oz silver bar, plus or minus 50%, you win it ; b) you're the winner, you get to pick between this 10 oz bar of silver (a little tarnished) (or 100 oz) or this Hershey bar (straight out the fridge) ; c) if you guess the value of this ounce of gold coin, within 25%, you win it ; d) hey, will you give me $20 for this 1 oz gold coin ?

Further, 1 year into "owning" Euro Pacific Bezzle and he's still under the delusion one can use a bank to spend money, lolz.

EV: But again, you're still thinking of it as an investment. You don't need to think of it like that. You don't need to buy Bitcoin and hold them for you to to get use out of the system. If you want to send some money to your friend in Argentina, you're not gonna be able to do that with most banking networks right now. You can buy Bitcoin, you can send them and he could sell them in Argentina within about 30 minutes.

PS: Yes, but if we do that, but that's going to be more expensive potentially than another means because the Bitcoin value can change five or ten percent easily during that half hour time period so there's a pretty big risk there in the market volatility. So, I'm saying right now they don't really work for that, for that purpose and what I'm afraid of is that you're going to have a lot of the early adopters trying to cash out a lot of people who got into the Bitcoin market recently are going to have a very sour taste in their mouth when they paid $1,200 for a Bitcoin and now they're worth $200. They're not going to want to buy any more Bitcoins and all of a sudden you have big PR campaign because you just expanded the market and now the newest customers are swearing off your product and so it kind of stops the momentum, you know ? But, hey look, I really I really appreciate Erik you coming on the show and look I appreciate everything that Bitcoin community is trying to accomplish. I mean, it's an admirable goal to get the government out of money and I want to get the government out of money. It's just that we have to offer legitimate money, we can't offer a fiat light. What the free market libertarian community should be wrapping its arms around would be a digital version of what the private sector used to issue as money before the government screwed it up. Before the government came in with a printing press, the private sector had paper money and it worked because it was backed by gold and I think digital currency will work if it's backed by gold. Whether it will work if it's backed by nothing, you know, this is an experiment that we'll have to see how it ends, but even if it does work, it will be copied it will be replicated, there will be lots of Bitcoin clones out there, so what they're all going to be worth in an interval in a universe of multiple hundreds of competing currencies and maybe it'll ultimately boil down to a handful that will survive who knows but who knows what the individual unit will be worth, nobody really does.

Peter's fixation on the price is really something to behold and even more so when you look back 8 fiat years later and find he hasn't given it up. If I had to wager, he's fixated with it because it's really the only argument he's had listed on his sales script for Gold. Sure, it worked in the 2000s and since he was for the most part pitching exclusively to retail ; the devil himself knowing not the minds of men aside, if I had to guess, I'd say he probably rationalized his abandonment of the Austrian school because those retail people weren't going to take the time to understand it anyways and at the end of the day he's "helping them" protect their purchasing power and collecting the commissions too, don't forget about the commissions.

Regarding new customers swearing off the product, he fails to distinguish between bad customers and good customers. The ones that are in it for FOMO and only buy for number go up in terms of fiat gainz and then turn around and panic sell when the number goes down are absolutely not ideal users of Bitcoin. Their not running nodes and aren't in it for the actual freedom Bitcoin helps one access, they don't want to put the work in to become rich or even understand what it means, they're simply after its trappings. Perhaps this is a trap that Peter has fallen into by only focusing on retail, I don't know. The best counterpoint to this is the decline from $15 to $2 MP experienced was harsher than the $1200 to $200 decline from 2013 to 2015, yet that didn't stop him, to the contrary.

There's a bit during the Q&A of Peter's Mortgage Banker's Speech from 2006(xxi) where a guy accuses Peter of recommending gold because that's what his company sells. Peter responds that he owns the company, so they ultimately sell whatever he thinks is a solid investment. Looking back today, I'm not so sure it's the case, because it's certainly questionable if he's doing any thinking at all or if he's completely wrapped up in the comfort of making a few bucks and the emotional attachment of being right when everyone else is wrong. I understand that it took balls for him to be calling out the tech bubble in the late 90s, "Why would you buy this company with no assets or income, when its market cap is greater than the entire New Zealand stock exchange ? Why would you want to buy a company with nothing when it costs more than a whole country ?" It took balls for him to be calling out the bubble in the 2000s, that it wasn't contained to subprime and that banks stocks were toxic. I admire him for going down to Occupy Wall Street with a sign that read, "I'm the 1%, let's talk." In the end though, rather than Bitcoin being a victim of it's own success as he claimed above, it looks like Peter Schiff has become a victim of his own success as he broke the fifth of The Seven Laws and wallowed content. For all he has talked about Bitcoin over the years, he has not actually researched it. He has not actually tried it out, never has he had a machine that downloaded the blockchain, just to see. It could be the case that he bought a machine that did get the blockchain synced, but if so, it was likely his son doing it as apparently he calls himself a Bitcoiner.

In the end, I think by now I've spent enough digital ink on Peter Schiff. I'm thankful for him because he's a stepping stone in my path of growth, but I'm also thankful to myself for having grown past him, at least when it comes to understanding wtf money is.

- Though I pretty much stopped listening to the show in about April 2012 after a) Peter argued the case of the state versus Stefan Molynuex arguing for anarchocapitalism and b) Peter wouldn't shut up about the Trayvon Martin/George Zimmerman case. At the time I was listening to get some insights about his market outlook I could use while smiling, dialing and closing, but he ranted incessantly about this case. [^]

- See the Smiling, Dialing and Closing link in footnote above for the story and pics. [^]

- A text conversation is non-blocking because both parties can be composing their thoughts simultaneously, submit them to the channel simultaneously and the messages won't interfere with each other. [^]

- Perhaps an unintentional pun, but, as this conversation ends up demonstrating, he's more of an economist than Peter, in my opinion at least. [^]

- Charlie Shrem as "CEO" and Winklevii as "investors". [^]

- Erik, Ira Miller, Barry Silbert (Digital Currency Group), Larry Lernihan (First Mark Capital) and Roger Ver were the shareholders, as far as I learned. [^]

- Seriously, such creativity with all the coins, bits, chains, blocks, etc. in the mix who can distinguish one from the other ? Gotta latch onto something someone unrelated did rather than rely on their own name and firma. [^]

- Erik listed one of the best investments in Bitcoin history, Satoshi Dice, traded as S.DICE on MPEx, which he later took private and reportedly sold to anonymous investors for 123k and change BTC [^]

- The 1.00000000 BTC convention doesn't exist in the code, Bitcoin uses integers, not floats, i.e. it's Satoshis all the way down. It emerged as a convention when the market price was much cheaper. By now, I find it healthier to think in terms of Satoshi and furthermore, rather than the Bitcoin price in terms of filthy fiat, think of the filthy fiats' price in terms of Satoshi. [^]

- A noted weakness of the Sharpe ratio is it relies on a normal distribution of returns. As Taleb writes extensively, returns on financial assets are not normally distributed. That being said, I don't reckon this hurts the case for Bitcoin as to my eye Bitcoin represents a Black Swan for fiat finance and a phase transition to sound money. [^]

- That is, a SHA-256 hash which has a certain number of leading zeros, depending on the difficulty. [^]

- Which I believe Peter is trying to allude to without citing it. [^]

- Which probably loads JavaScript from half a dozen 3rd parties, including Google and Facebook and Twitter too. [^]

- Maybe the are, maybe they aren't, but there's more that goes into value than price. [^]

- Worthy means economical, i.e. he who has the money may spend it, he who doesn't may not. Bitcoin blocks still remain less than the 1MB limit the

global warmingscalability pholks were crying wolf over in 2014. [^] - Fast forward to present and this also includes whenever a bureaucrat has a panic attack, whether it be the Czar of the CDC or NIH or OSHA or OMFGBBQ. [^]

- When I sat in Peter's Westport office for my Euro Pacific interview in January 2012, it was indeed Winblows operating for Microsoft on his desk. [^]

- Calls to mind that Bill Hicks bit, "The Iraqis, great weapons, incredible weapons." "How do you know ?" "We checked the receipt." [^]

- It was pretty clear Bitcoin was in bubble territory in December 2013 after doing 100x in a year. If said buyer had a little patience, read, e.g., the Bitcoin prices, Bitcoin inflexibility article, and dollar cost averaged that $1M, say putting himself on a monthly buying schedule, he'd have accumulated lot more than 800 BTC by perhaps a factor of 2 or 3 ; and that doesn't even consider taking a profit in the 2017 bubble and buying back lower after the weak hands were shaken out. [^]

- Ethereum, the biggest altcoin pretending to contend with Bitcoin, is executing on their scheme to officially cede the mining battle to Bitcoin as they transition to proof of nothing in 2022. [^]

- Overall I'd say it's a pretty good speech, he was speaking as if the bubble had already burst, which apparently it had, but still took a couple years for the rest of the world to see. [^]

[...] No Hussein Bahamas as POMPOUS in there though as 'twas published prior to the forum, and not like Peter was savvy enough to read it in the first place. Anyways, fuck them, they don't get the name their [...]

Pingback by Syntax destruction is the fountainhead of fiat propaganda on Dorion Mode — April 14, 2023 @ 03:35

[...] de Einstein, realizing Euro Pacific Bank was a bezzle and that Erik understood money better than Peter Schiff. Meeting Jacob at philosophy meetup I organized at what's now known as Noa and forming a freneship. [...]

Pingback by I'm not from there, but it's where I was born. on Dorion Mode — April 20, 2023 @ 04:24